One of the benefits of hiring an experienced divorce attorney is to assist you in the decision-making process. An experienced lawyer can help you avoid potential unintended consequences of the decisions that you make during your divorce.

One consideration that often gets overlooked is how the divorce may impact the ability for children of divorced parents to qualify for college financial aid.

Although the college financial aid process can be complicated, a well-thought-out strategy addressed during the parents’ divorce can maximize the potential that the child will qualify for federal financial aid.

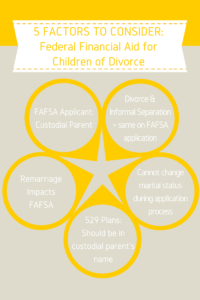

Five of the factors for parents to consider are listed below:

Which Parent is Responsible for Completing the FAFSA?

Only the custodial parent is required to complete the FAFSA (Free Application for Federal Student Aid). For FAFSA, the custodial parent is defined as the parent whom the student lived with the most during the 12 months preceding the date the FAFSA was completed.

If the Decree and Parenting Plan is not clear about which parent spent more than 50% of the time with the student, then the parent who provided the most financial support to the student for the previous 12 months must complete the FAFSA.

When possible, being strategic about which parent is chosen as the custodial parent in the Decree and Parenting Plan can give the student the best chance of qualifying for the most financial aid. For example, if your current Decree and Parenting Plan provide that the parents each spend equal time with the student and requires the parents to equally divide the expenses for the student, modifying your Decree and Parenting Plan to allow the lower income earner to have 51% of the parenting time will ensure the lower-earning parent is deemed the custodial parent, which will maximize eligibility for financial aid.

Something to keep in mind is that colleges can ask for a copy of the Decree and Parenting Plan to verify living arrangements when reviewing FAFSA applications. Thus, modifying the actual documents through the Court is essential.

Divorce and Informal Separation are Treated the Same on the FAFSA.

Parents do not have to be formally divorced or formally legally separated to benefit from only one parent having to complete the FAFSA. An informal separation is treated the same as a divorce or legal separation on the FAFSA. The only requirement is that the parents

live in separate households. Thus, if your divorce is not final, but you are informally separated from your spouse, only one parent should complete the FAFSA.

Marital Status as of the Date the FAFSA is Completed Matters.

If your FAFSA is completed and is being processed, and you subsequently separate from your spouse, you can’t go back to update your marital status on the application. If you are considering divorce or separation and the FAFSA deadline is looming, keeping this in mind may impact the timing of separation and/or submission of the FAFSA application.

Remarriage Impacts FAFSA.

Another consideration is that if the custodial parent re-marries, the step-parent’s income must be reported on the FAFSA as well. For example, if a student’s divorced parents both made modest incomes, there is a good chance the student would be a candidate to qualify for need-based aid. However, if the custodial parent remarries prior to the FAFSA application date to a stepparent with a high income, that stepparent’s income must be included on the FAFSA application and would impact that student’s ability to qualify for federal aid.

529 Plan Divorce Considerations.

A 529 Plan is an education savings plan designed to help families set aside funds for future college expenses. However, how the 529 Plan is handled in the divorce can significantly impact the student’s future financial aid eligibility.

If the 529 Plan is in the custodial parent’s name, it is treated as an asset on the FAFSA and reduces the student’s possible aid by 5.64%. For example, if the 529 Plan had $20,000 in the account, the total aid would be reduced by $1,128 (5.64%).

However, if the 529 Plan is owned by the non-custodial parent, it is not included as an asset because the non-custodial parent does not complete the FAFSA. Instead, distributions from the account will count as untaxed income to the student on the following year’s financial aid application. This could reduce aid eligibility by up to 50%.

As such, it’s more favorable for the custodial parent to own the 529 account due to the minimized impact on financial aid eligibility.

Angela Lennon