Kirsten’s life tragically ended in violence. I continue this series by looking at another, and all too common, form of domestic abuse.

It seemed reasonable in the beginning – supportive even. He said he would handle the finances once they moved in together. He earned a bit more than her so she trusted that he would be fiscally responsible. When they joined households, they also joined finances. She provided all of her accounts, passwords, and trust.

“Why did you spend $123 at Target?” he demanded to know. She recited her purchases confused over his anger. “You need to follow the budget. From now on, I will give you cash only to spend.” Gradually he took her name off the checking and savings accounts and removed her as an authorized user from the credit cards. She didn’t even notice it was happening.

At first, he was generous with her “allowance” and it didn’t cause an issue because she was able to afford what she needed. Citing bad spending habits, he steadily decreased the amount over time until she was allowed only $100 per month despite bringing in several thousand a month through her net pay.

She believed what he told her: she was terrible with money, and he was securing their financial future. She felt stupid and simultaneously grateful that he was looking out for them.

When he bought a new motorcycle for himself, she questioned how they could afford for him to have two vehicles. “I earn the most money and I am entitled to it.” He sneered at her.

After years of emotional abuse and finally getting her daughter through high school, she knew she needed to see a lawyer and get out. She was distressed to learn she would have to pay a consultation fee. She had no access to money. It would take her seven months to tuck away enough from her allowance without it being noticeable.

When she told the lawyer her financial situation the lawyer asked if she had any family or friends to help pay the retainer on her behalf. “I haven’t told my family or friends anything,” she said as shame washed over her. “I haven’t even really talked to anyone in months.”

She was completely isolated and without access to her own paychecks. She was terrified of what he would do when he learned she had set up her own account and redirected her employer’s direct deposit at the advice of her attorney. She was afraid of the retaliation that would come.

She wasn’t even considering at that time that he had moved significant amounts of their money into accounts she knew nothing about. She didn’t know, nor would she ever learn about the safety deposit box that contained thousands of her hard-earned dollars in cash.

While her attorney worked diligently to ensure she received her share of the marital estate, she processed that she had to rebuild credit because she hadn’t been listed on any accounts for years. The depth of the dire financial situation he had left her in wouldn’t be fully realized for some time.

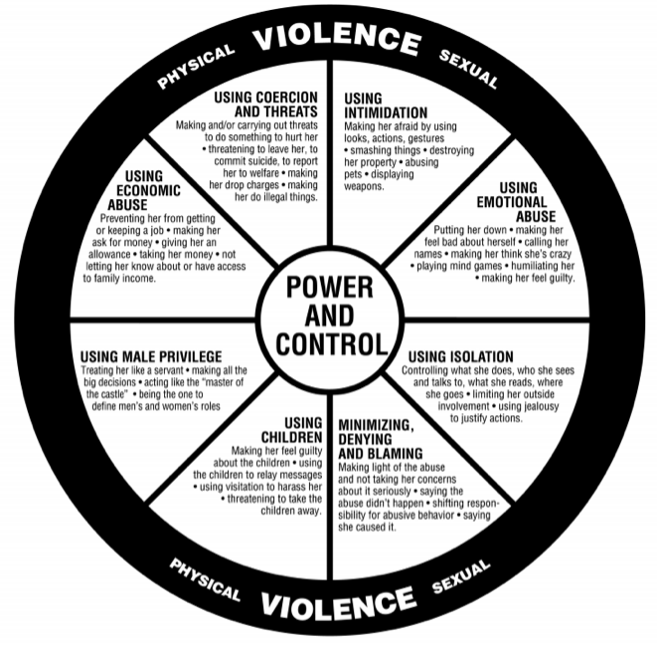

She was a victim of financial domestic abuse.

If you recognize abusive traits in your partner, please talk over your concerns with a family law attorney, therapist, or local domestic violence prevention organization. You can call the 24-hour national domestic violence hotline at (800) 799 – 7233 or call the Women’s Center for Advancement (WCA) at (402)345-7273. The WCA can assist anyone in the Omaha area who is experiencing domestic violence, sexual assault, stalking, or human trafficking. They can help address immediate safety need and can provide ongoing emotional support. While it may be difficult to leave an abusive relationship, you do have choices; your safety and that of your children should be your top priority.